The Gist: Who makes money from inflation?

Inflation squeezes the living, but delivers windfall benefits to certain companies. This is the Gist.

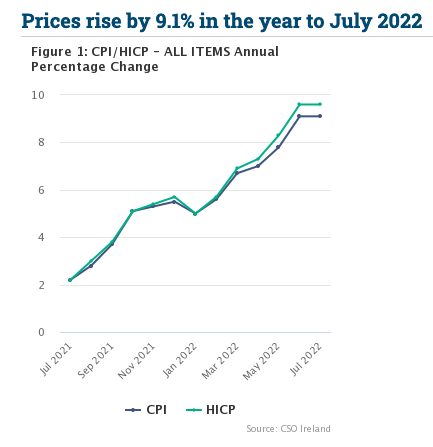

For the second month running, the CSO reported that Ireland's prices rose at the highest rate for over thirty years. The annual rate of inflation so far in 2022 has reached 9.1%.

So all of the prices went up and nobody can afford to do things or exist. Except, that isn't true for everyone.

First, let’s acknowledge that inflation is causing serious hardship. That is what the phrase “cost of living crisis” is intended to cover. Literally being just alive is becoming increasingly unaffordable, with housing the biggest and worst crisis amongst all the others. Inflation particularly hurts people on fixed incomes —social welfare recipients, like pensioners. It's why talk of addressing increasing living costs by lowering taxes is particularly ugly. It pays some of the state's finite resources to the people who have money already (through taxed earnings) and pays nothing to those inflation most sharply harms.

Stretched like elastic

If your income is fixed but the prices of the things you have to buy to live keeps going up you soon stop being able to buy anything but staples, and eventually, not even staples.

However, because no economic event effects everyone the same (because there are lots of different ways of being, financially speaking) there are people who benefit from high inflation. They’re not representative of the population, but it is worth knowing about them.

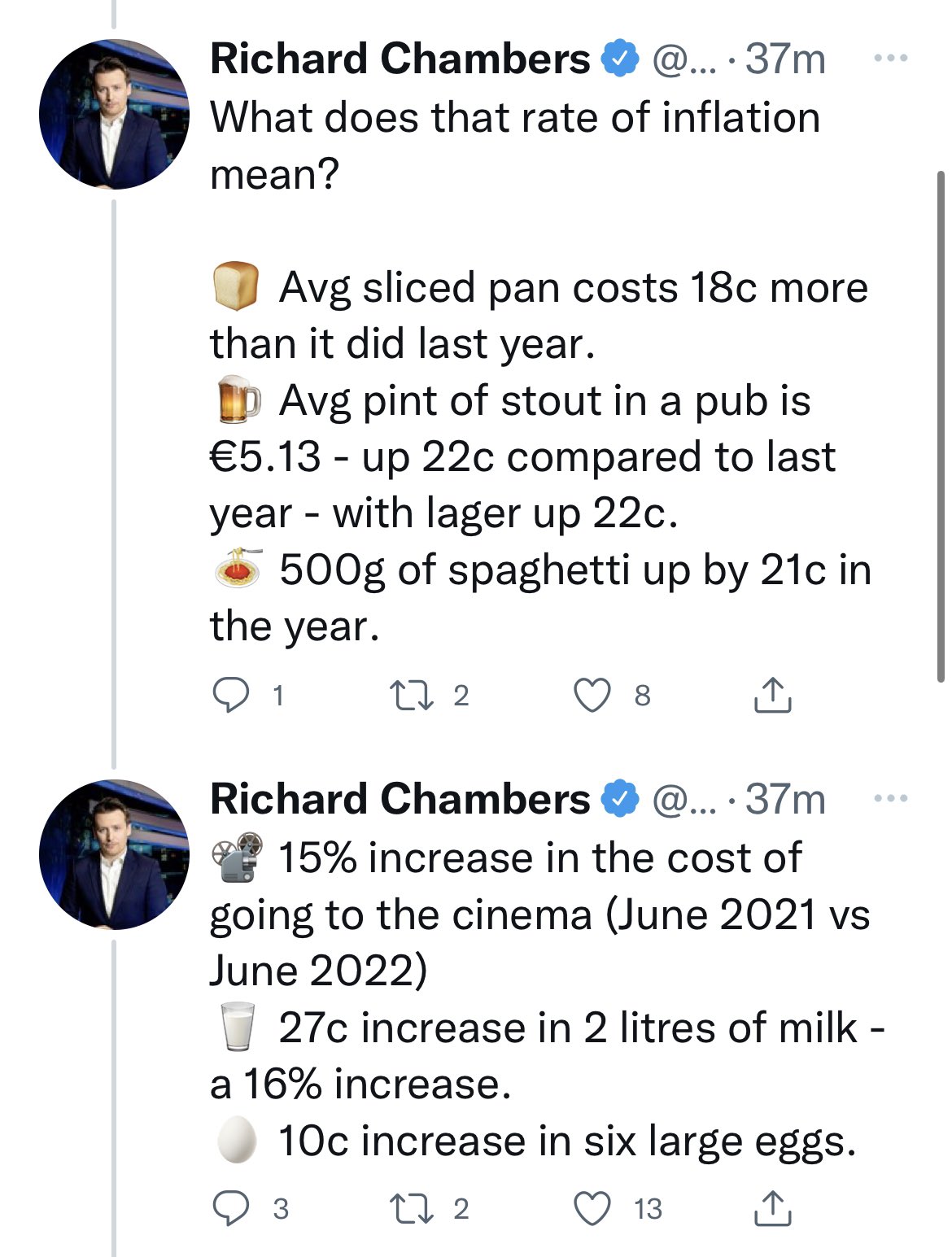

Firstly there are those commercial entities who have what is known as high price setting power, which is tied to price inelasticity. That’s a bunch of economics jargon, so let’s stomp on it so the meaning squirts out like the contents of a school milk carton.

Imagine you could just put up your prices for things and people would still buy them. Or you could put up prices by 40% but there would only be a 10% drop in consumption. If prices are unhitched from demand like that, there’s said to be lots of price inelasticity.

They're inelastic, because people will stretch instead, in the same way medieval peasants used to stretch to fit the rack in their King's dungeons.

The glaring example of this in Ireland in the last few months is energy costs. They've increased by 21.6% since January. Increasing cost by 21.6% didn’t reduce consumption by 21.6%. Instead it increased energy profits.

In fact, those profits went up, a lot. For example, Bord Gais Energy's UK owner reported that their profits in the Irish company had gone up 74%.

Profits are what a company has after its supply expenses are paid. War or no war, it looks like opportunistically increasing energy costs in a time of high inflation has been a profit maximising, not cost-covering, choice.

Inflate the debt away.

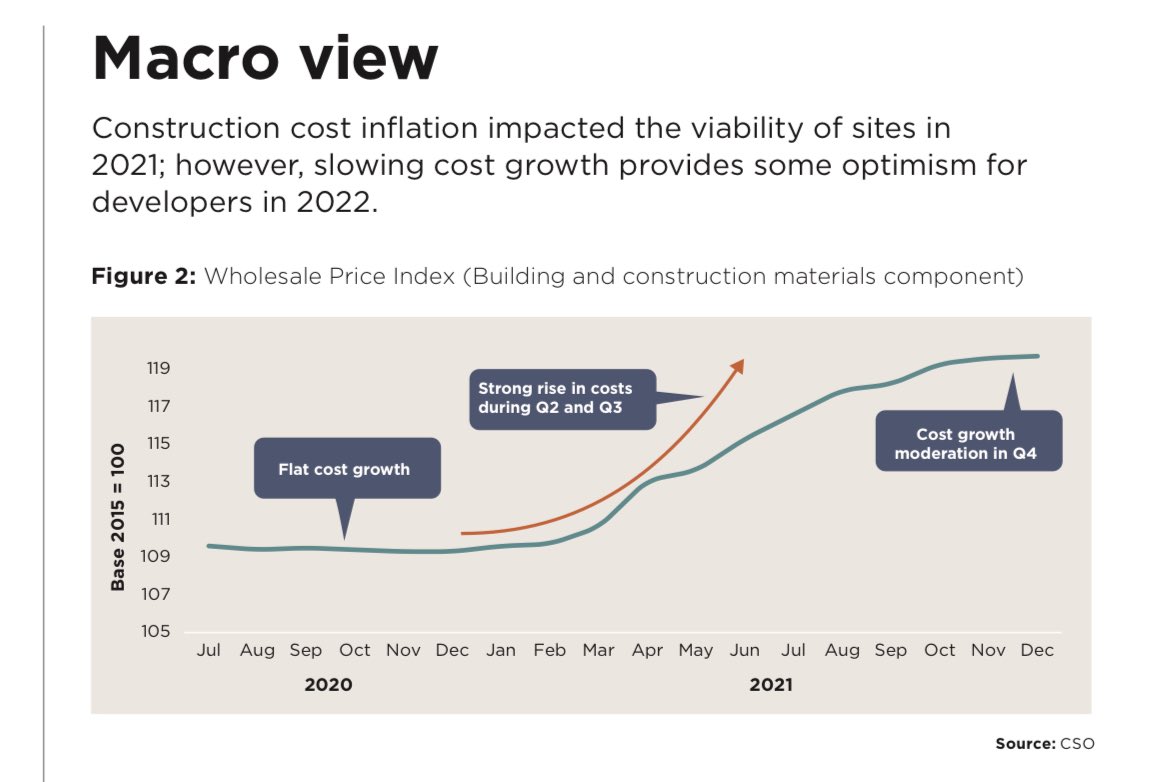

Another way in which an entity might benefit from a period of high inflation is if they have a great deal of pre-existing borrowings which they had used to purchase a lot of non-depreciating assets. For example, developers who have borrowed very large sums to build up land banks of development land.

None of this is hard to understand- literally schoolchildren learn it (that’s where I learned it) but it is weirdly occluded or obscured in media or public discussion. Inflation helps entities who borrowed cash in the past and used it to buy appreciating assets.

Let’s shrink this down. Imagine it is 2017 and I am a delveloper company. I go to a bank and I borrow, say, €100m and then I buy a bunch of land zoned to build houses on. I have to pay interest on that- pretty modest single digits, given prevailing interest at that time. Then I do literally nothing. Grass grows.

Meanwhile the value of my asset is increasing far more than my interest costs. But on the other hand, if I build during an inflation spike, my costs will be higher. But my assets can sit there accumulating value if I just... don't build anything yet.

Problem: What about that debt from buying the land?

Answer: Inflation!

During a period of high inflation, the value of the cash I borrowed shrinks, relative to the value of the land I used it to buy. I am making an unrealised profit every single day on my whole bank of land I refuse to build houses on. I have become a farmer of unearned money- literally a new rentier classs, but without the bother of having actual tenants to make pay me rent.

The only thing that could go wrong for me in this novel new profit farm arrangement is if my land value falls. So the one thing that I—the debt holding, land bank hoarding developer company do not want is for housing (and therefore land) prices to fall.

Now, coincidentally, about this time last year The Gist had a relevant observation to make on the one thing the Government would not do, or even say they wanted to do, in response to the housing crisis.

“It is anathema to the government parties to ever try to cause a drop in house prices- or rent. And that is why our current policy machinery had failed to solve this social crisis for over a decade.” - The Gist, 5th Sept 2021

When we recognise that a particular outcome is simply out of bounds for political discussion– and particularly when it is an outcome that seems like it would have general popular support– we should not look to expressed intent to identify for whom public policy is crafted.

We should look at the effect of that policy and who it benefits most.